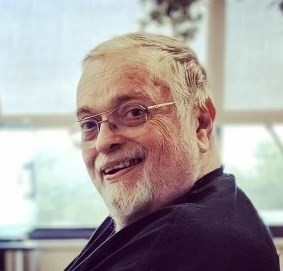

William M. Sparks 1945 - 2023

William M. Sparks 1945 - 2023

My father, William (Bill) Sparks, passed away sadly but comfortably Sunday morning, surrounded by his family. He was a kind and loving man with a heart of gold. There are so many who loved him and will feel this loss – in the business world and far beyond. He would say thank you to all of his small-business customer for their support, and he would wish everyone peace and happiness. I have run the William M. Sparks Insurance Agency for many years now, and I will continue to run it just as my father did and as he would want me to do. On behalf of my family, I thank you all for your kind words, well wishes and support at this time. --- Danielle Sparks

As a business owner, you know the effect that workers’ injury and illness can have on your business productivity and bottom line. Perhaps you also know that putting in place the right Workplace Safety Program can help to mitigate the risk and expense and help to hold down work-related injuries and illness and thus minimize the cost of your Workers Compensation coverage at the same time. This is especially true since a large part of your premium for workers comp insurance is based upon claim frequency.

As a business owner, you know the effect that workers’ injury and illness can have on your business productivity and bottom line. Perhaps you also know that putting in place the right Workplace Safety Program can help to mitigate the risk and expense and help to hold down work-related injuries and illness and thus minimize the cost of your Workers Compensation coverage at the same time. This is especially true since a large part of your premium for workers comp insurance is based upon claim frequency.

Workplace Safety Program should be OSHA compliant

The safety program you implement should comply with the Occupational Safety & Health Act (OSHA). Why is this important? Because insurance carriers typically have an interest in how effective and comprehensive your Workplace Safety Program is as they decide whether to provide your coverage. If you need help with compliance, OSHA can provide information, consultation and/or training as needed.

How can an in-house Safety Manager help?

Each company’s Workplace Safety Program should be uniquely tailored and should typically include written guidelines and safety procedures for employees’ reference. Your company’s plan should designate an in-house Safety Manager who will implement the program, coordinate periodic safety inspections, train and educate new as well as existing employees, and motivate employees to avert unsafe work practices.

On-site first aid care and return-to-work protocol are important

Workplace accidents may still occur, even with a well-designed safety program in place. Thus, it is important that your program provide for on-site first aid care. Ultimately, if/when an employee requires absence from work due to work-related injury or illness, your program should include an effective return-to-work protocol.

Workers Comp just one type of Business Insurance

Here at the William M. Sparks Insurance Agency, we are available to answer your questions regarding Workers Compensation coverage and to discuss any other business insurance needs. Feel free to contact us any time for more information.

Learn More about Workers Compensation

Here at the William M. Sparks Insurance Agency in Lutherville/Timonium, MD, our experienced agents welcome your questions and can assist you by reviewing your current insurance policy and helping you to exploring your insurance coverage options. Why not contact us at your convenience?

We've all heard the stories: A company loses key resources due to a shooting spree by a former employee... A business is wiped out by earthquake or flood... A corporate data center is destroyed by fire and brings down a national network. As a business owner, you probably sympathize but then rationalize that business insurance or government agencies like FEMA will be able to help.

While business insurance benefits and government support offer financial assistance, will affected companies continue doing business in the wake of such disaster?

Would your business survive a significant disaster?

It should – if you have an up-to-date Business Continuity Plan that includes a tested Disaster Recovery Plan, and provided that all key people in your organization know how to use it.

What’s that? You have a Business Continuity Plan?

On the shelf since 2001, you say? In that case, you might only consider yourself safe if supply vendors, computers, employees and business process are all exactly as they were back then. (Of course, that would likely mean that you have other business issues.) You might ask yourself the following questions:

- When was your business continuity plan (BCP) last updated? In fact, have you designated someone to maintain it?

- If so, how well is that working?

- How do you know whether your BCP is “in shape “ and ready to see your business through a disaster, large or small?

Don’t have a Business Continuity Plan or a Disaster Recovery Plan?

Wondering where to start and how to create one? If you are a large corporate organization, this is a good time to seek out a reputable consultant who knows your industry. If you are a smaller business, the following guidelines might be all you need.

- List your key employees and their alternates, and be sure to add their critical functions and all possible contact information for each. It might be worthwhile to determine who among them is able to telecommute if necessary.

- Then list vendors, contractors and other resource contacts who are critical to your business operation, including those external professionals and services you would need to help you restore your processes.

- Identify important in-office equipment as well as heavier, external equipment and vehicles, and note important details such as vendors, serial numbers, etc. Also consider how you might quickly replace these items if they are destroyed, and note the details.

- List primary legal documents, insurance policies, bank records and details, etc., and note where each is kept. Consider attaching copies to your plan.

- Research and decide upon an alternative location where you can resume business if your primary site is destroyed, and collect all necessary contact details so that you could make arrangements quickly if needed.

- Organize all your material and document exactly what steps are needed to carry out the plan.

- Compile all material and make copies for your key participants, and keep the master copy in a safe place.

- Educate your internal and external contacts and then test your plan, making changes as needed.

- Designate someone to handle Business Continuity Management in your organization so that this plan remains current and available.

The Impact on Your Business Insurance

Your business insurance portfolio and your business continuity plan complement each other. How can you know how much and exactly which insurance coverage you need if you have not analyzed your processes and resources to develop your business continuity plan? How can you complete your BCP without considering your business insurance coverages? Together they provide your business with a strong safety net.

Is it time to evaluate your business insurance portfolio?

Here at the William M. Sparks Insurance Agency in Timonium, MD, we welcome the chance to review your policies with you, answer your insurance questions, and offer advice to make your business as prepared as possible to handle any disaster. So why not contact us today?

Tag Cloud

|

|

|